It is the time up to which an invoice should be issued and such date would be counted as the time when tax becomes payable to the government. The time of supply is the most important factor to be considered regarding the issue of an invoice. Now let us understand important concepts, regarding GST invoices issuance in the case of a supply of goods and services and in other cases.

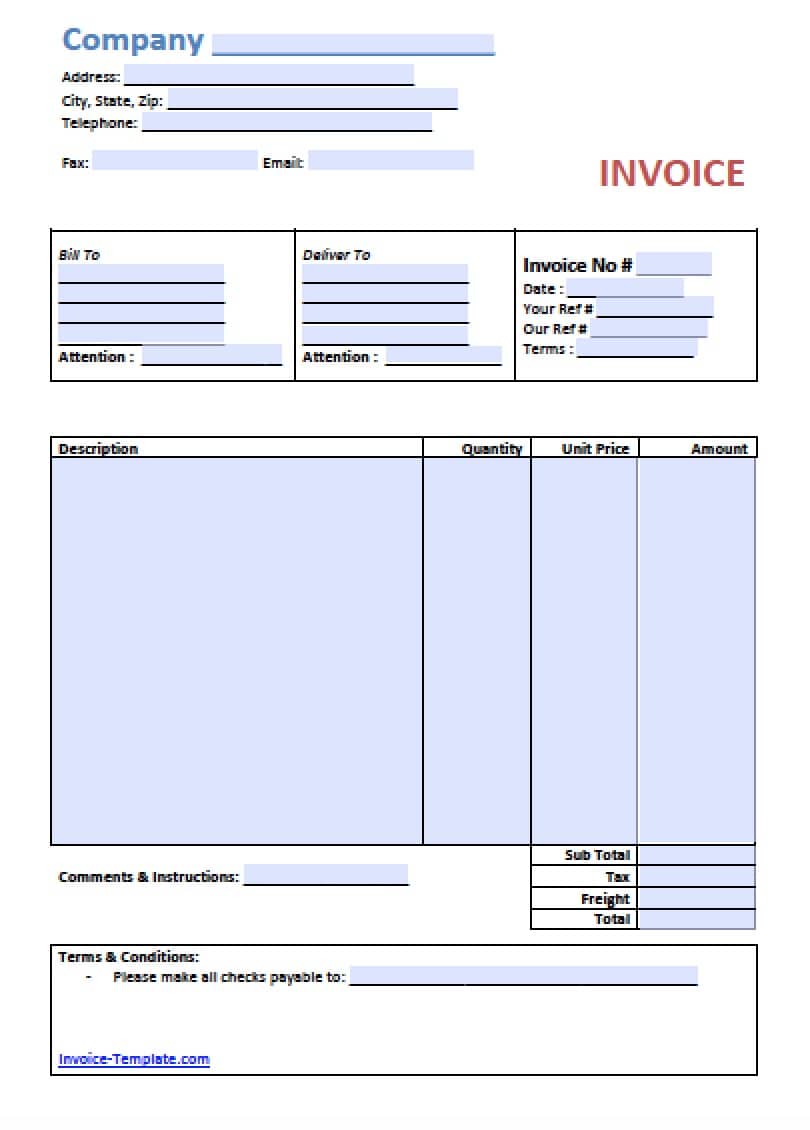

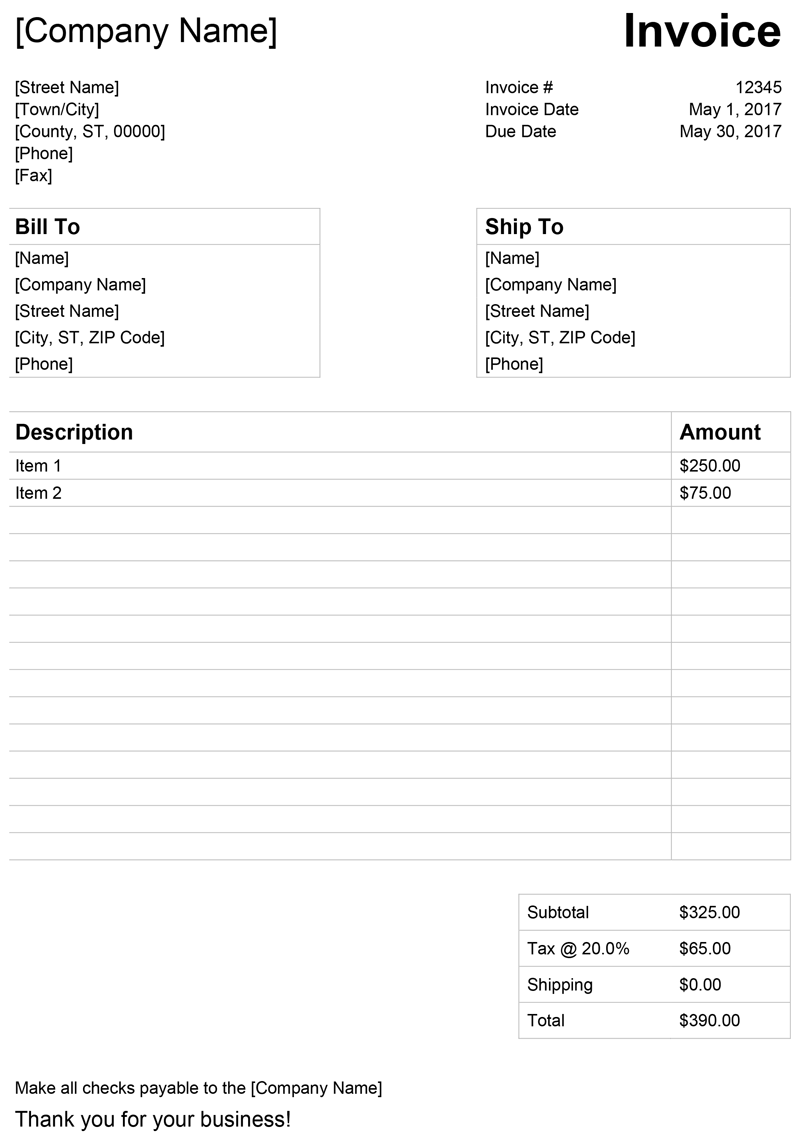

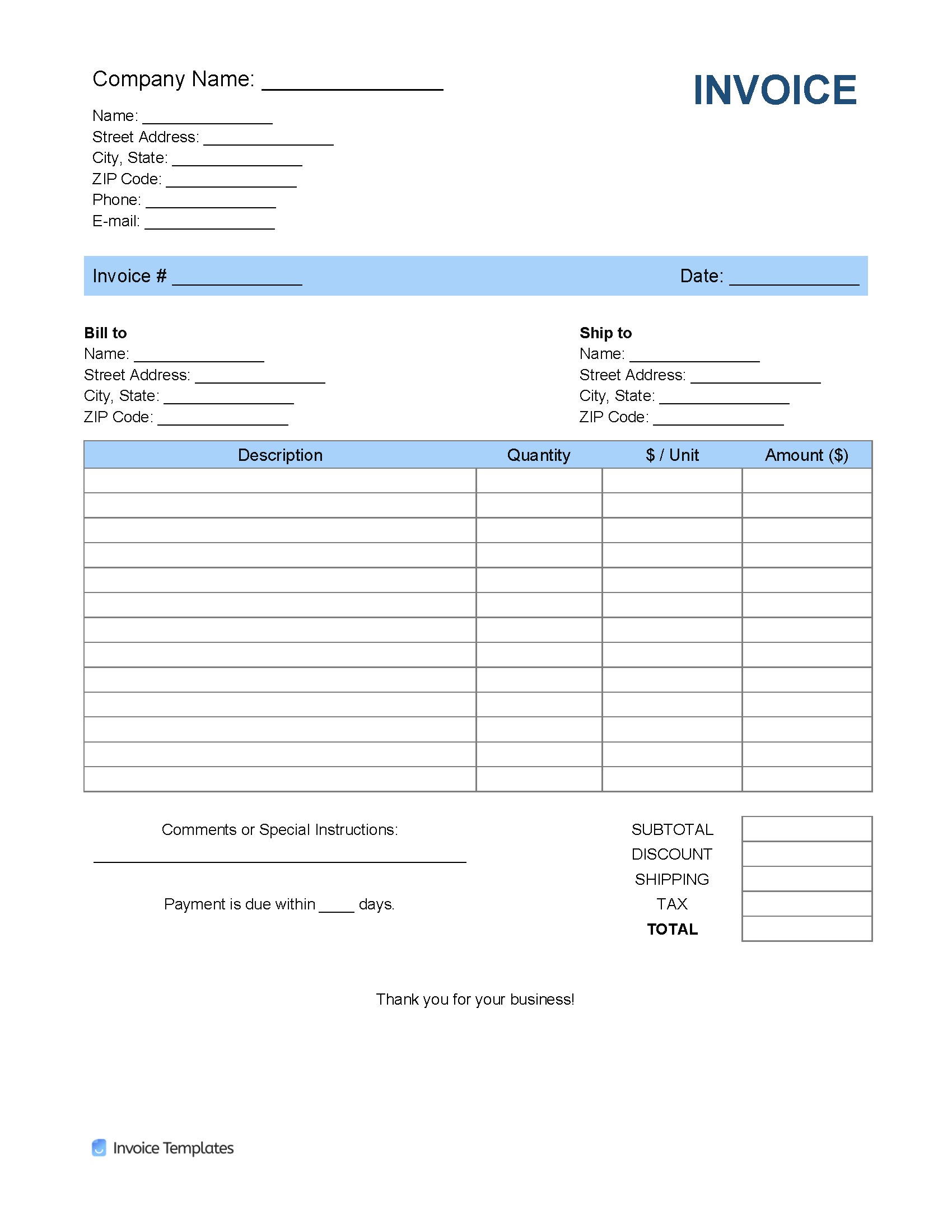

200 then no need to issue a tax invoice in case of Business Consumer transactions. In case of the value of goods and services or both supplied is less than Rs. Once the invoice is issued as per GST law, GST is payable even if no payment is received from the recipient. 2.5 Lacs a consolidated revised tax invoice may be issued separately in respect of all unregistered recipients located in a state. In the case of inter-state supply, where the value of a supply does not exceed Rs. (e) Other details of Unregistered recipient.Ĭonsecutive serial number should not exceed 16 characters for a tax invoice and one or multiple series shall be maintained for the financial yearĪ consolidated revised tax invoice can be issued for all taxable supplies made to an unregistered person. (d) Name, Address & GSTIN/UIN of the recipient. Contents of GST InvoiceĪ GST invoice should have the following details such as Most simple invoice format for service providers.Īfter downloading the invoice always check whether the invoice format contains all “Contents of requisite GST Invoice” which are provided below. The most commonly used GST invoice format is mostly used by retailers.ĭownload GST invoice format 2 in PDF GST Invoice format for service providers In case GST rate is different on items, then add two columns in standard format for Rate and GST amount and total item wise below. GST Invoice format for Manufacturing entitiesĭownload GST Invoice format in excel for manufacturing unitsĭownload GST Invoice format in PDF for manufacturing units GST Invoice format for tradersīifurcate the GST Amount into IGST/ CGST & SGST. You can download the GST Bill format in excel or other formats and edit it as per your own terms and conditions. GST Billing format in Excel, PDF, and Word & Time of Supply Person Supplying Taxable as well as Exempted Supply.

Consolidated & Revised Invoice as per Section 31(3)(a).

0 kommentar(er)

0 kommentar(er)